Being More

Discover how Morris Insurance can be your partner in finding the right coverage for your needs.

info@rjmorris.ca

235545 23rd Line,

Thamesford, ON N0M 2M0

Tel: 519.283.6608

Fax: 519.283.6012

Monday to Friday 8:30am – 4:30pm

Discover how Morris Insurance can be your partner in finding the right coverage for your needs.

235545 23rd Line,

Thamesford, ON N0M 2M0

Tel: 519.283.6608

Fax: 519.283.6012

Monday to Friday 8:30am – 4:30pm

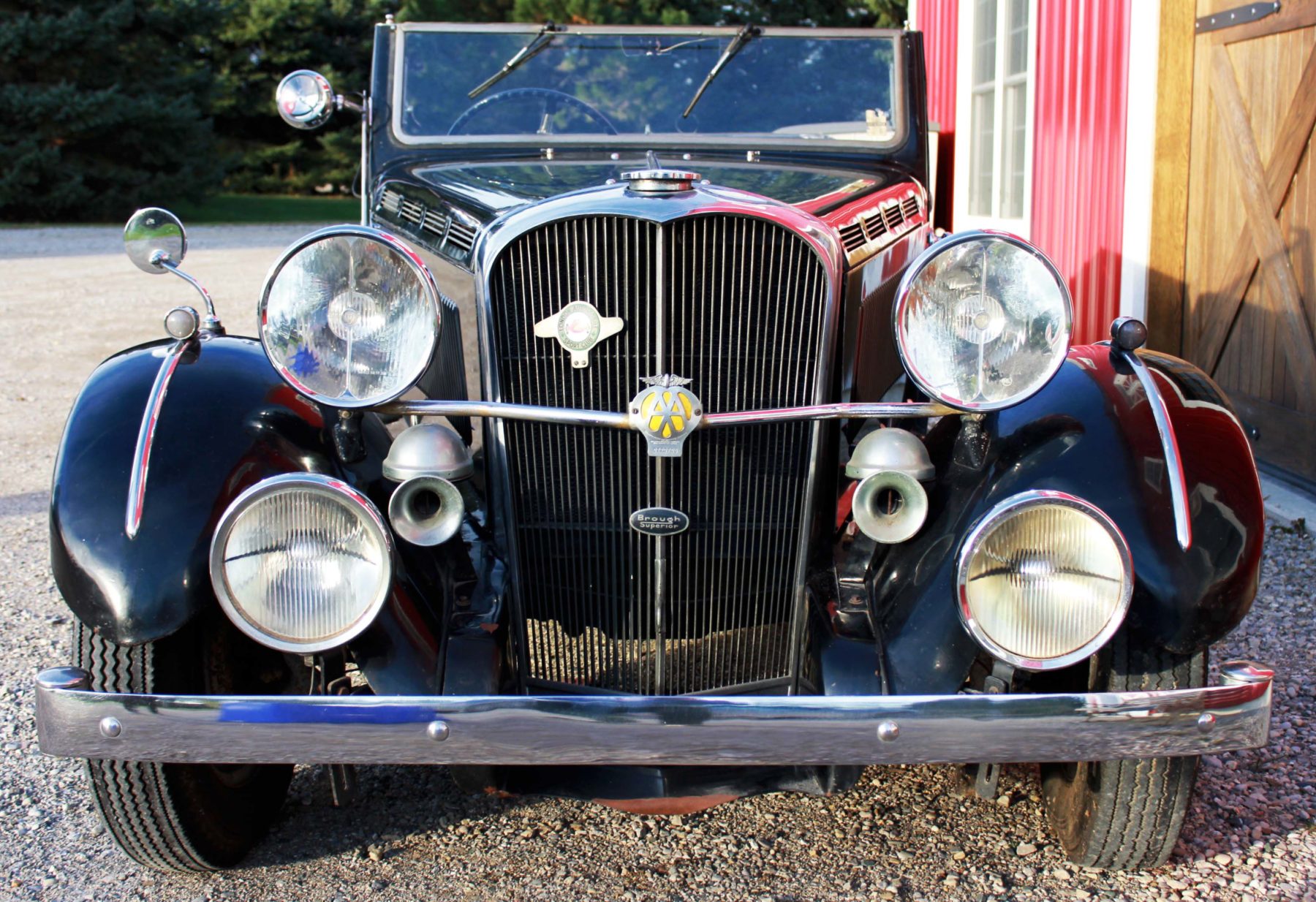

Classic Car Insurance

Agreed Value Coverage

One of the most significant differences between classic car insurance and standard auto insurance is the agreed value clause. With agreed value coverage, you and your insurer agree on the value of your car before the policy is issued. Should the car be stolen or written off, you receive the full agreed amount—no depreciation calculations or haggling over market value.

Flexible Usage Restrictions

Classic and antique car insurance policies often allow for limited, pleasure-only usage, such as:

Spare Parts and Restoration Coverage

Many collectors are actively restoring their vehicles. Classic car insurance can include coverage for parts and restoration projects, so your investment is protected even before the car is road-ready.

Expert Tip

Before diving into insurance specifics, it’s important to clarify what qualifies as a classic or antique car. In Canada, insurers and automotive organizations generally consider:

These aren’t just “old cars.” They're often meticulously maintained, appreciated in value, and driven less frequently than daily-use vehicles.

Why Standard Auto Insurance Isn’t Enough

Standard auto insurance policies are designed for modern cars that depreciate over time and are driven regularly. Classic and antique cars, on the other hand, often appreciate in value and are used sparingly—typically for exhibitions, parades, or pleasure drives. A standard policy might not adequately cover:

That’s where specialized classic car insurance policies come in, offering tailored protection for your prized possession.

Why Choose Morris Insurance?

Morris Insurance is not just another brokerage. We are antique car collectors ourselves! And, we have decades of experience serving Canadian collectors, restorers, and enthusiasts. Our team understands the unique value, maintenance, and care that classic and antique vehicles require.

We work with leading underwriters who specialize in classic and antique car insurance, ensuring you get the best coverage and competitive rates.